ebike tax credit status

The credit was capped at a maximum of 7500. As stated you might get up to a 1500 credit to defray 30 of the cost of an electric bike.

Bikes Archives Dōst Bikes Electric Bike Bike Motorized Skateboard

The credits also phase out according to household income.

. The bill includes a refundable 30 tax credit for certain types of ebikes that cost up to 4000. As part of Bidens Build Back Better bill individuals who make 75000 or less qualify for the maximum credit of up to 900. This credit would be available to all e-bike purchasers regardless of socioeconomic status a common divider in tax credit bills.

The credit expired in 2012 so this new push would just re-up it. Watch the AMP Electric Vehicles website for an announcement. B Limitation.

Other activity may have occurred on another bill with identical or similar provisions. The E-BIKE Act creates a credit against your federal taxes of up to 1500 per taxpayer. This is not a motorcycle this is an e-bike.

Any American who makes 75000 or less qualifies for a credit of up to 900 on one bike. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States. Rebate level is twice as large for low income up to 600.

Jimmy Panetta D-CA introduced in February Schatz and Markeys proposal would offer Americans a refundable tax credit. Information about Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file. The credit can go toward purchasing one new e-bike with a price tag of 8000 or less.

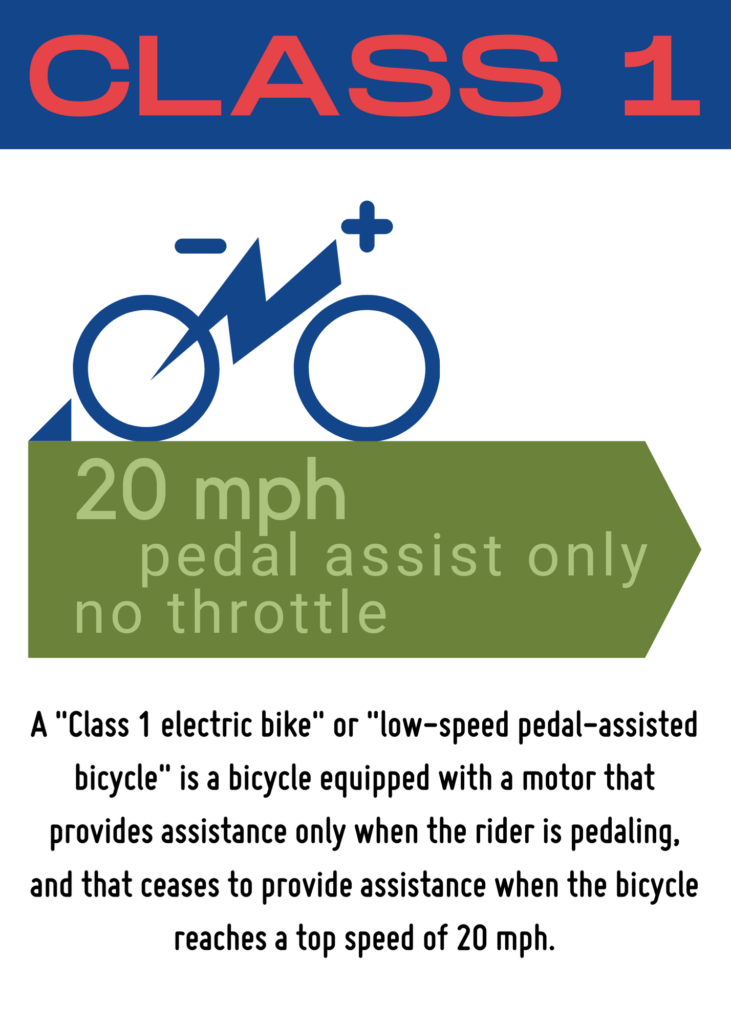

This credit amount would be doubled in the case of a joint tax return where two family members purchased eBikes. Class 1 2 and 3 electric bikes of a value of up to 8000 qualify for the credit. Status Introduced on Feb 11 2021 This bill is in the first stage of the legislative process.

Electric Bicycle Incentive Kickstart for the Environment Act or the E-BIKE Act This bill allows a refundable tax credit for 30 of the cost of a qualified electric bicycle. It will typically be considered by committee next before it is possibly sent on to the House or Senate as a whole. The law has not yet been passed as of August 2021 but if approved it would allow 30 with a total limit up to 1500 to be refunded per taxpayer on the purchase of an e-bike.

Sharon Shewmake D-Bellingham On Tuesday by a 57 to 39 vote the Washington House of Representatives passed HB 1330 exempting electric bikes and up to 200 in bike accessories from state sales taxes. E-BIKE Act Specifics and Challenges. Benefits of getting Tax Credits For Ebikes.

The credit has a limit of 1500 or 30 of the total cost whichever is less. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit. TurboTax Premier Online 0 3 5234 Reply.

Couples who earn up to 150000 can buy two bikes and qualify for a credit of 900 each. The Senate Finance Committee just okayed a 10 percent tax credit worth up to 2500 for e-bike and e-motorcycle purchases. Beginning in 2022 taxpayers may claim a credit of up to 1500 for electric bicycles placed into service by the taxpayer for use within the United States.

The version of the social safety net and climate bill that was passed by the House of Representatives offers some Americans a fully refundable 30 tax credit on purchases of certain e-bikes. Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year.

Electric motorcycles already receive a 10 federal tax credit but that figure was tripled to 30 in the new bill according to the Washington Post. Joint filers who make up to 150000 can qualify for two bikes and up to a 900 tax credit on each. As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000.

10-20 rebate for new ebike purchase up to 300 20-40 up to 600 for low income Tiered rebates. 12 What are Ebikes. There is no specific deadline for claiming the tax credit for an e-bike purchase but it is typically available to taxpayers who file their taxes by April 15th of the year following the year of purchase.

Both bills have the same goal which is to allow a refundable tax credit for 30 of the cost of a qualified electric bicycle. For ebike cost 500-999100 rebate 1K-1999200 2K up300. Bikes that cost more than 8000 would not be eligible and the 30 percent credit starts to phase out for bikes that cost more than 5000.

The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. It was introduced into Congress on February 11 2021. A taxpayer may claim the credit for one.

A Class 1 2 or 3 e-bike purchase qualifies for the credit. Washington House passes e-bike sales tax exemption Posted on March 11 2021 by Ryan Packer Rep. This tax credit is an essential step toward recognizing e-bikes as a crucial green transportation option.

The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500. Much like the House bill which Rep. How can I files for this credit.

Electric motorcycles already receive a 10 federal tax credit but that figure was tripled to 30 in the new bill according to the Washington Post. The credit is limited to 1500 per taxpayer less all credits allowed for the two preceding taxable years. This means you can buy an electric bike costing as much as 5000 or more to get the full 1500 credit.

The program is also means-tested based on tax status meaning the credit would begin phasing out 200 for every 1000 spent on the purchase for individuals who earn 75000 heads of household earning 112500 and married.

As E Bikes Surge New York City Tries To Keep Up Bloomberg

/cdn.vox-cdn.com/uploads/chorus_image/image/69626470/1311180591.0.jpg)

The Senate S E Bike Act Could Make Electric Bikes A Lot Cheaper The Verge

Ebike Classifications And Laws San Diego County Bicycle Coalition

What Makes A Good Electric Bike Incentive Program Peopleforbikes

Let S Pass The E Bike Act Rei Co Op

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

Understanding The Electric Bike Tax Credit

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

E Bike Act Will Create Vital Tax Credit For E Bikes Calbike

Powering Their Way Into The E Bike Boom Forbes Ebike Bike Electric Bike

/should-i-buy-electric-bicycle-everything-you-need-to-know-primer-faq_color-a0ed8ab6ba9d4e8bbf0b949127f46114.png)

Should I Buy An Electric Bicycle Here S Everything You Need To Know To Get Started

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Electric Bikes Are Still Selling Like Crazy And That Might Even Increase Soon

Denver Launches Nation S Best E Bike Rebate Program

New E Bike Act Introduces 30 Us Federal Tax Credit For Electric Bicycle Purchases Electric Bicycle Bicycle Ebike

900 E Bike Tax Credit Possible In Build Back Better Bloomberg